Hey founders,

Welcome to another edition of My Unicorn Club - The Startup Newsletter - It’s a biweekly FREE newsletter written by those on this side of the table (VCs & Investors) for those on that side (Founders & Startup Enthusiasts).

Today’s article is co-written with

Harshith is a law student with an interest in technology startups and venture capital, documenting his learnings and journey through this exploration. These insights do not constitute professional investment advice.

This article is inspired by one of his works. : ‘Beating the J Curve in Private Equity’

Ever wondered how some startups bleed money for years, yet investors still line up to fund them?

It's not just individual companies that follow this pattern. Most investor firms operate the same way & its turns out, its not a losing bet but quite the opposite.

Introducing the J-curve phenomenon.

Before we begin,

I wanted to share two resources that could accelerate your fundraising journey:

150+ Investors Database with contacts

I've spent months curating this comprehensive database, which includes:

30+ Accelerators

20+ Incubators across different sectors

30+ Angel Networks with active deal flow

50+ VCs from seed to growth stage

Get it now at a steal price. (I also create custom investor lists based on your specific requirements - just email me for details - bhowmiksayanee1050@gmail.com)

1:1 Strategy Session

Having strategized with 60+ founders so far, I'm opening up my calendar for focused 35-minute sessions. If you'd like to pick my brain about fundraising, go-to-market, or scaling challenges, book a call now

What Exactly Is the J-Curve?

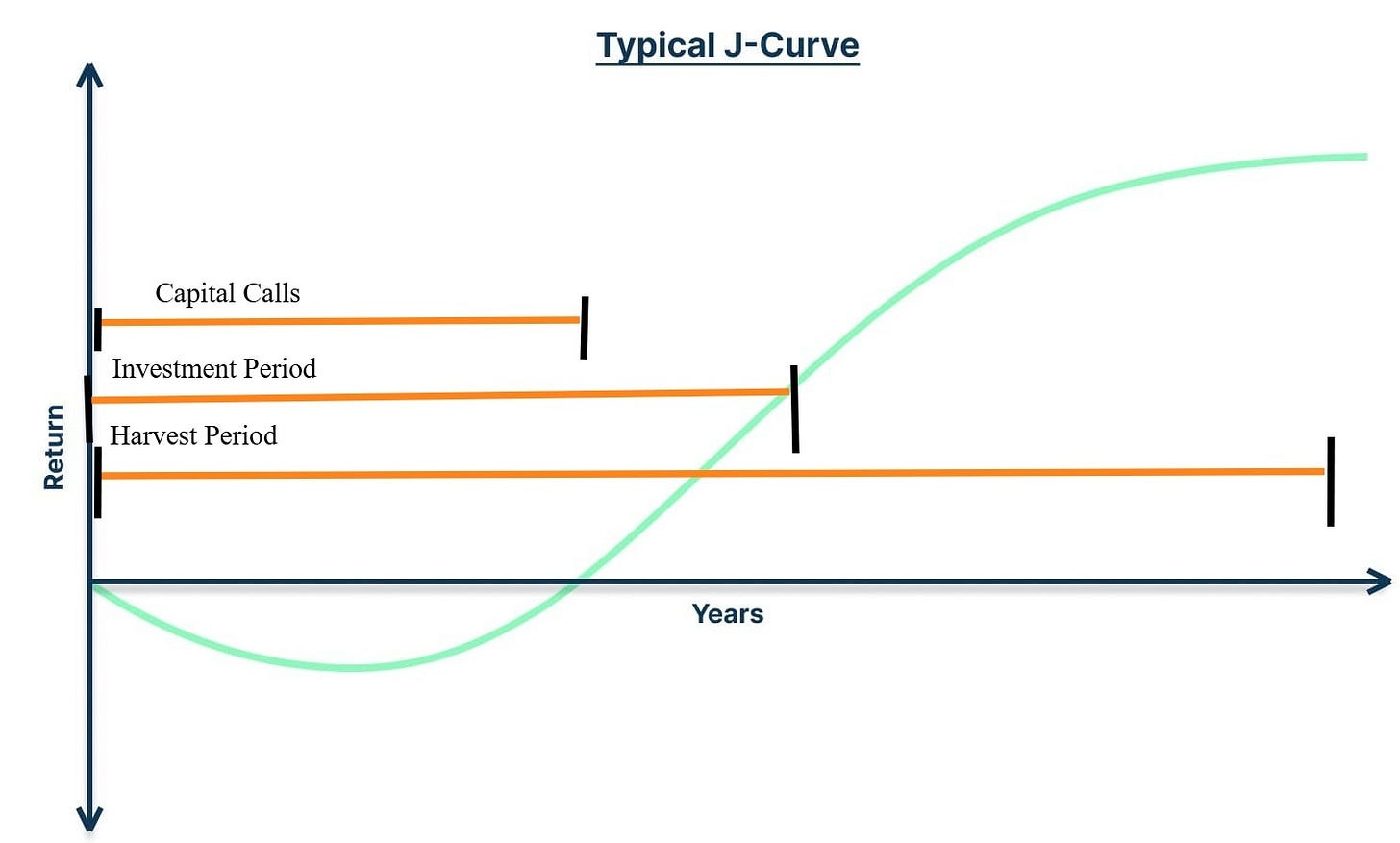

The J-curve gets its name because it looks exactly like the letter "J" on a performance chart:

It starts with a dip below zero (losses)

Then shoots upward into substantial gains

This pattern shows up everywhere:

Economics: Currency depreciation initially worsens trade, then dramatically improves it

Medicine: Patient recovery often gets worse before getting better

Private Equity: Funds lose money for 2-4 years before generating big returns

But here's the key insight: In private equity, the J-curve isn't a problem to fix. It's how the business model is designed to work.

Why Does the J-Curve Happen? The Four Money Drains

Think of a PE fund like a startup that buys other startups. Just like your startup has costs before revenue kicks in, PE funds face four major expenses upfront:

1. Management Costs (The Ongoing Bills)

PE firms charge 2% annual fees on committed capital

A $100M fund = $2M per year in fees

This covers salaries, offices, and operations, whether deals perform or not

2. Investment Costs (The Deal-Making Expenses)

Due diligence is expensive: legal fees, audits, and consultant reports

Each deal can cost $500K-$1M just to evaluate

For 15-20 investments, these costs pile up fast

3. Operational Fees (The Improvement Investments)

Portfolio companies need immediate upgrades

New management teams, IT systems, and consultants

Necessary investments that drain cash short term

4. Immature Portfolio (The Waiting Game)

Early investments haven't had time to grow

A $10M software acquisition might need 3-4 years to become worth $50M

Time lag between investment and value creation

The Three-Act Drama: How the J-Curve Unfolds

Act 1: Capital Calls (Years 1-2)

Unlike your Series A, where you get money upfront, PE works differently. When investors commit $10M to a fund, they don't write the check immediately. The fund "calls" money in pieces as deals happen.

Example: Sequoia might have $1B committed but only calls $100M in year one. The remaining $900M sits earning almost nothing in bank accounts.

Act 2: Investment Period (Years 3-5)

This is where the magic happens. Fund managers execute their playbook:

Operational improvements

Strategic acquisitions

Market expansion

Team optimization

Early exits start generating returns. The "J" begins its upward swing.

Key stat: The median PE fund turns positive in year 4, with peak returns in years 6-8.

Act 3: Harvesting Period (Years 6-10)

The fund becomes a money-making machine:

Portfolio companies get sold (IPOs, acquisitions, buyouts)

Returns flow back to investors

Fund performance levels off as investments wind down

How Smart Investors Beat the J-Curve

Sophisticated investors have cracked the code with three strategies:

Strategy 1: Secondary Funds - Skip the Early Pain

Instead of investing in new funds, buy existing stakes from investors who want out early.

Why it works:

You buy into year 3-4, closer to the upward swing

Often get 10-20% discounts on the actual value

Secondary funds generate 14-16% returns vs 12-14% for new funds

Real example: In 2022, Lexington Partners bought growth equity stakes at a 15% discount, creating instant value.

When you buy me a coffee, it's more than money to me; it's a validation of my work and motivates me to bring more value to the community and pay forward

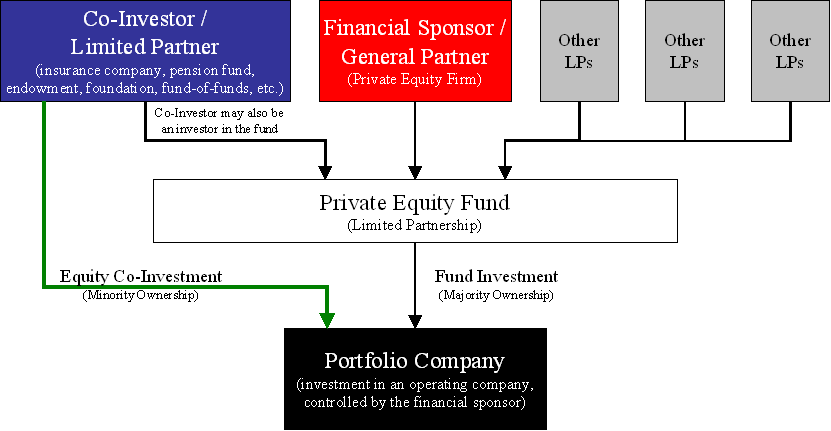

Strategy 2: Co-Investments - Cut Your Fees in Half

Invest directly in specific companies alongside the PE fund, usually without paying fees.

The math: If you invest $1M in the fund + $1M in co-investments, you've halved your fee burden. This can add 2-3% to your annual returns.

Plus: Money gets deployed immediately, no waiting for capital calls.

Strategy 3: Credit Facilities - Borrow to Deploy Faster

PE funds can borrow against future investor commitments to invest immediately.

Example: A fund with $100M in future commitments might get a $30M credit line for faster deal-making.

Warning: This adds leverage. During downturns, losses get amplified too.

The Performance Scorecard

Here's how different strategies compare:

Primary PE Funds: 12-14% returns, 4-5 year J-curve

Secondary Funds: 14-16% returns, 1-2 year J-curve

Co-investments: 15-18% returns, immediate deployment

Fund of Funds: 8-10% returns (double fees hurt)

What This Means for You as a Founder

Understanding the J-curve changes everything:

Set Realistic Expectations. Your PE investor might seem less active in years 1-2. They're not lazy - they're managing cash flow across their entire portfolio while waiting for earlier bets to pay off.

Negotiate Better Terms

Knowing how fees work helps you understand your investor's motivations and constraints. Use this knowledge in deal negotiations.

Plan for the Long Haul PE partnerships typically last 5-7 years. The J-curve explains why patience is required from both sides.

Appreciate Operational Focus. Early operational investments might seem expensive, but they're designed to accelerate your path to bigger returns.

Today's Market Reality

The J-curve has gotten longer and deeper:

Median exit time: 4.2 years (2015) → 5.8 years (2023)

Higher interest rates make the early years more painful

Exit markets are tougher, extending the waiting period

Smart investors are adapting by:

Increasing secondary allocations

Demanding more co-investment opportunities

Using credit facilities strategically

Focusing harder on operational improvements

The Bottom Line

The J-curve isn't a flaw in private equity - it's a feature that rewards patient capital and smart operations.

As a founder, think of your PE investors not as impatient money seeking quick flips, but as long-term partners aligned around building lasting value.

The most successful founder-investor relationships treat the J-curve as a natural phase requiring:

Strategic collaboration

Operational focus

Shared commitment to long-term results

Remember: In private equity, like in startups, the biggest wins require time, patience, and strategic thinking.

The investors who understand how to navigate and optimize the J-curve are the ones you want as partners. They've learned that superior returns come not from avoiding the initial dip, but from managing it intelligently while accelerating the path to the upward swing.

Got questions about PE investing dynamics? Hit reply - I read every email and your questions often become future newsletter topics.

Found this helpful? Share it with a founder navigating the fundraising world.

Until next week,

Sayanee & Harshith

If you like reading My Unicorn Club - The Startup Newsletter - spread the word and share it with someone who might need it :)

Hey! I saw your post pop up on my homepage and wanted to show some support. If you get a chance, I’d really appreciate a little love on my latest newsletter too always happy to boost each other!