How Market Timing decided Your Funding Success (And What to Watch Right Now)

Exclusive interview with an economic researcher - Understanding how market forces determine startup fundraising landscape

Welcome to another edition of My Unicorn Club - The Startup Newsletter - It's a biweekly FREE newsletter written by those on this side of the table (VCs & Investors) for those on that side (Founders & Startup Enthusiasts).

Today is a special crossover edition of My Unicorn Club! I'm thrilled to have

, the mind behind as our guest today.As a PhD holder and someone with three years of corporate research experience, he brings sharp insights into how recent market news affects individual investors. His publication aims to cut through the fog and deliver market clarity, minus the noise.

Alan and I had a discussion a few days back & understood that the same economic forces that move public markets also shape the startup fundraising landscape. And understanding this connection isn't just helpful—it's essential for timing your next round.

Hence, today’s edition, we will explore a very fascinating intersection of:

Retail Investing with Startup Fundraising Economy & Market.

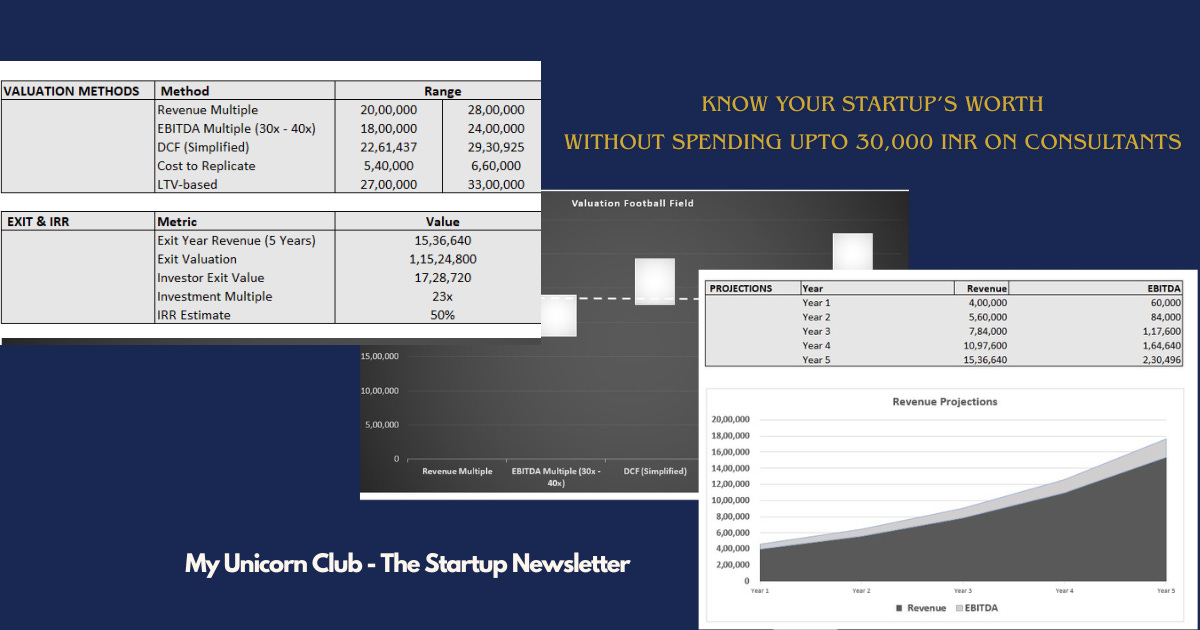

Before we start, try this tool to simplify your valuation decisions.

Startup Valuation Calculator —

Get Investor-Ready in 10 Minutes

Financial consultants charge ₹20,000 to ₹30,000 to build early-stage startup valuations.

You can do it yourself — in just 10 minutes — using this simple, founder-friendly calculator.

This single-sheet tool estimates your startup’s valuation using 5 proven methods:

→ Revenue Multiple, EBITDA, DCF, Cost to Build, and LTV-basedIt also models:

Your 5-year revenue and EBITDA projections

Investor IRR, ROI, and exit value

A football field graph that visualizes your valuation range

🎁 LIMITED OFFER: Use Code MUC50 to get a 50% OFF

(Valid till , Thursday July 10 — Regular Price ₹899)

Let’s begin…

1. Alan, could you tell us a bit about yourself? First Phd and then corporate research, sounds fascinating. So, how did you become a researcher?

It all started in the library. I went to graduate school in China–as a European student on a Chinese municipal government scholarship–and I had to write my master’s dissertation in Chinese. In order to learn how to write, I had to read. A lot. I practically lived my life in the library those years, and I noticed that I wasn’t hating it–much the opposite, I found it quite enjoyable. A passion of reading turned into a passion of writing, and I went on to do my PhD, graduating in 2021.

I studied international politics, but the principles of good research are directly applicable in a corporate environment. So, I managed to land a couple of jobs as a risk analyst where I had to profile companies for a living. I found this niche vibrant and exciting, so I am naturally drawn to it in my everyday life in- and outside of working hours.

So, the passion of writing and corporate research turned into a Substack account, and here we are today.

2. You often analyze how big economic trends affect public markets. Which trends or signals do you think startup founders should keep an eye on right now?

In the short term (monthly), nonfarm payrolls, consumer price index and producer price index trends move markets. These data points come out monthly and they roughly capture inflation and the state of a country’s economy. If they come in line with expectations, markets tend to shrug off the effect, but surprising numbers can send stock prices soaring or plummeting.

I think startup founders would benefit from observing these trends because they reflect risk appetite in a given geography. High inflation lowers risk appetite because it weighs on corporate earnings. Given that equity is a risky asset, lower risk appetite means less interest in it. I think this logic goes beyond public equity and applies to startups, too.

In the near term (bimonthly or quarterly), it makes sense to keep a close eye on central bank decisions. Central bank meetings are less frequent than inflation data releases, but they could have a bigger effect. At these meetings, central bank officials decide to raise, hold, or cut interest rates, depending on the economic state of a country. They may raise interest rates to pump the brakes on inflation, or cut them if they want to inject more vitality into the economy. If the economic indicators are inconclusive and they are not sure how to proceed, they usually keep interest rates unchanged

Interest is the cost of borrowing money. High interest rates mean more expensive borrowing. Given that startups are in the beginning of their corporate journey, they often need leverage to grow. The cost of this leverage is significantly higher in a high-interest rate environment than in a low-interest rate environment. So, if I was about to kickstart my company, I would keep an eye on central bank meetings.

In the long term (annual and more), it pays off to keep an eye on policy developments. Policy priorities tend to translate into better access to funding in prioritized sectors. The EU recently made an effort to turn the continent into a “startup powerhouse” with the EU Startup and Scaleup Strategy. This means that there will be more money going to startups, but not all startups. The strategy prioritizes certain industries, such as artificial intelligence, quantum technologies, advanced semiconductors, medical technology, biotechnology, and bioeconomy applications. AI funding is also clearly prioritized in the US, with the new Stargate AI Project.

So, startup founders also benefit from tracking the political winds and seeing if there is an opportunity for more funding from government agencies.

3. Many retail investors understand how rate hikes affect stocks and mortgages. But what about startups? What are some ways higher rates of inflation could affect startup valuations or how much capital founders can raise?

Inflation — and the interest rate hikes that typically follow — affect startups more subtly but significantly.

To begin with, high inflation often signals uncertainty in the broader economy. That kind of environment tends to push investors toward safer, more liquid assets. Startups, being inherently risky and illiquid, become less attractive by comparison. So even if the fundamentals of a startup haven’t changed, investor sentiment might cool, leading to more conservative valuations and smaller funding rounds.

Then there’s the cost of capital. Startups usually rely on a mix of equity and debt to scale. In a high-interest rate environment, debt becomes more expensive, which can delay hiring plans, product development, or market expansion. Equity investors, in turn, may demand better terms or lower valuations to compensate for that higher cost of capital and tighter liquidity.

So while inflation and rate hikes might seem like distant macroeconomic issues, they can meaningfully affect how much capital founders can raise — and at what cost.

Read more about “Cost of Capital” here

4. Retail investors have become more influential—think meme stocks, Reddit trades, and TikTok-driven investing. Do you think this retail activity in public markets has any knock-on effects on startups or the private markets?

I have a conservative predilection. I think that at the core, share prices are driven by fundamentals–solid fundamentals beget good earnings, which lead to higher share prices.

On the surface, retail sentiment can trigger short-term changes, such as highs or lows divorced from fundamentals–think of the Gamestop incident or other constituents of the meme stock phenomenon. However, correction usually kicks in, and the share price evens out to reflect fundamentals.

The knock-on effect on startups is probably nuanced rather than foundational. Venture capital firms have dozens of criteria to evaluate startups. “Meme stock potential” is one of the factors worth considering in these evaluations. For instance, consumer-facing startups may be more exposed to the opportunities or risks associated with becoming a meme stock.

5. Both startup investing and retail trading involve risk and a lot of emotion. What are some habits that you think help navigate this kind of high-risk, high-reward environment?

Emotion is the enemy of returns. Disposition bias and the lack of discipline are the usual culprits why retail traders sell their winners too early and hold on to their losers for too long.

Two habits can counter most bad decisions, and I broadly base this proposal on Benjamin Graham’s seminal book, The Intelligent Investor. First, taking research seriously. There is no point in getting into the investing game without proper preparation. Reading up on investing strategies, asset allocation, position sizing can go a long way in utilizing opportunities and mitigating risk. This foundation becomes essential during drawdowns–when everyone is panic selling, astute investors are bargain-buying.

Second, keep detailed records. It is best to record every investing decision and circle back to those records when considering next steps. For instance, Kraft Heinz, a stock owned by Berkshire Hathaway–a very successful multinational holding company led by investing legend Warren Buffet–is going downhill these days, closing in on a 52-week low. Do you sell, hold, or buy more? That depends on why you bought the stock in the first place. This is a good time to consult old records and see if the original rationale still stands.

6. Let’s talk monetary policy. Central banks in the US and EU are still keeping things tight. In your view, how do those decisions ripple into the startup fundraising world, especially for early-stage companies?

In the US, the Fed has kept interest rates steady this year in the 4.25%-4.5% range. The European Central Bank cut rates to 2% in June, and reporting suggests it plans to end cutting.

On a general level, higher interest rates are a challenge for startups because the cost of borrowing money is higher. On a granular level, the impact is also industry-dependent. Highly leveraged industries like construction or real estate suffer more in a higher interest rate environment. Certain banks, brokers, and insurers, on the other hand, benefit from higher rates.

Building on this argument, my hypothesis is that fintech startups have a better chance of securing funds in a higher interest rate environment than a real estate startup focusing on sustainable housing.

7. You’ve likely seen how retail investor confidence moves markets. Do you think this kind of sentiment also affects how easily startups—especially B2C ones—can raise funds?

There is a saying attributed to Mark Cuban that ‘Everybody is a genius in a bull market’. He reportedly said this in 2020, when the Federal Reserve bought corporate debt and U.S. bonds as part of its effort to keep the financial system on the go during the pandemic. Almost everyone in the stock market was making money, regardless of fundamentals, and retail investors became more risk-acceptant. Guess what? Proceeds from IPOs and venture capital went up as well. So, when the bulls are roaring and investors are risk-acceptant, startups have a better shot at raising funds as well.

8. As a PhD‑trained researcher, you likely track macro indicators closely. Which ones should both startup founders and retail investors pay close attention to this year?

2025 seems like a very unpredictable year, when regional conflicts proliferate and trade wars simmer.

In the US context, I would keep a close eye on trade agreements between Washington and its trade partners. Stocks tend to get a boost when progress is announced on that front. At the same time, external conflicts–like the one simmering now in West Asia–seem to have a mixed, but substantial effect on markets.

On the other side of the Atlantic, the EU is rolling out major initiatives that aim to enhance the supply chain and defence resilience of the continent. These proposals include significant financial pledges–€200 billion (~$234 billion) for AI, for instance–that lift markets in general and certain industries, like defense, in particular.

In conclusion, 2025’s market moves are primarily shaped by policy developments on both sides of the Atlantic, so retail investors and startup founders would benefit from tracking them closely. Based on the developments so far, I would say that startups in the defense and AI realms are well-positioned to gain funding.

What This All Means for You🫵

Alan made it crystal clear that your startup isn't living in its own little bubble. The same elements that make stock prices jump around—inflation reports, what the Fed decides, government policies, etc—are also changing how investors look at your pitch deck.

I know this might sound overwhelming, but let me break it down into bite-sized action pieces:

This month :

Just keep an eye on those monthly economic reports (CPI, inflation stuff). Think of them as a temperature check on how willing investors are to take risks. When inflation is high, investors get nervous. When they're nervous, they're pickier about deals.

The next few months :

Watch for Fed meetings. I'm not saying you need to become an economics nerd, but these meetings literally decide how expensive it gets for you to borrow money. And let's be honest—most of us need to borrow at some point.

Rest of the year:

If you're in AI or defense, you're sitting pretty. The U.S. and EU are throwing serious money at these sectors. Sometimes, timing is everything, and this might be your time.

Remember : The best founders aren't the ones who ignore the economy. They're the ones who see what's coming and adjust their strategy accordingly.

Time for a quick poll:

Until next time, keep building!

P.S. Forward this to any founder friends who might be fundraising—they'll appreciate the clarity.

Resources:

Startup Valuation Calculator Use - MUC50 for 50% OFF

Pre-Money ↔ Post-Money Calculator Use - MUC50 for 50% OFF

If you like reading My Unicorn Club - The Startup Newsletter - spread the word and share it with someone who might need it :)

Interesting perspective!

Timing is one of the most critical factors when considering product launch or fundraising or even investing. There are other interesting sectors especially focused on sustainability across Europe (including climate technology, IoT, digital twins) that attract substantial govt and private market funding.

Thanks, Charu! You’re absolutely right timing plays a pivotal role. What’s interesting about sectors like climate tech and digital twins is that they benefit not just from macro timing (like regulatory shifts or green funding pushes), but also from cyclical hype curves. A tech can be “right” in terms of mission, but still be too early commercially. Timing success often lies in syncing tech readiness with policy windows and capital appetite. Europe’s focus on sustainability is a great example of this convergence.