How much company to dilute in each round? A founder's guide

If Investor ask for 30%, point them to this newsletter :)

Hey founders,

Welcome to another edition of My Unicorn Club - The Startup Newsletter - It’s a biweekly FREE newsletter written by those on this side of the table (VCs & Investors) for those on that side (Founders & Startup Enthusiasts).

Before we begin,

*Option A: Dynamic Investor Database 📊

A continuously updated list of active investors mapped by sector, check size, and investment thesis - all for a tiny monthly subscription of just 99 rupees.**Option B: VC Mechanics Crash Course 🎓

A comprehensive guide specifically for first-time founders explaining term sheets, cap tables, liquidation preferences, and how VCs actually make decisions internally.

Let’s begin…

As someone who's spent time on the investor side of the table before moving to the mentor side, I wanted to share some critical insights on fundraising dynamics that might save you significant equity in your next round.

The Real Data on Seed Round Dilution

If you're raising capital and investors are pushing for 30% ownership in your seed round, you need to go back with data. The market reality simply doesn't support those terms.

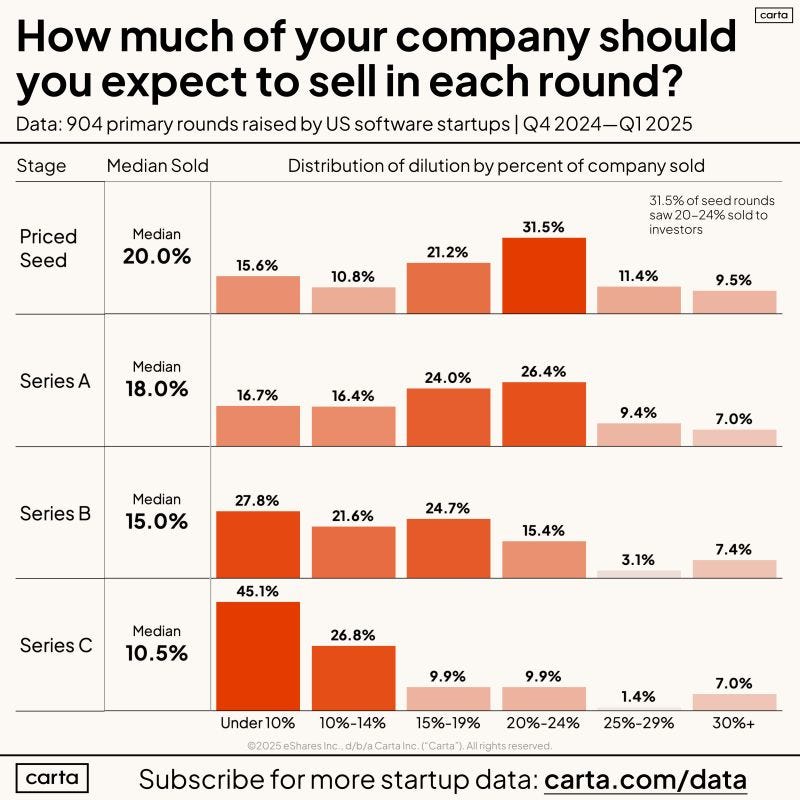

Looking at recent data from Carta covering 904 primary priced rounds raised by US startups in the software sector over the last six months, here's what the real market looks like :

🔍 Priced Seed Rounds

Median dilution: 20%

Under 10% dilution is actually more common than over 30%

Only about 8% of deals involve 30 %+ dilution

🔍 Series A

Median dilution: 18% (slightly down from early 2024)

Most deals cluster in the 15-22% range

🔍 Series B

Median dilution: 15%

Wide distribution under 25%

Outliers above 25% are typically distressed situations

🔍 Series C

Nearly half of all Series C rounds dilute less than 10%

Median dilution: 10.5% across all rounds at this stage

Mature companies have significantly more leverage

The "Only Term Sheet" Trap

I've seen countless founders accept excessive dilution because "it's our only term sheet." While cash constraints are real, remember that accepting 30% dilution at seed has massive downstream implications:

You'll likely need to raise 3-4 more rounds before exit

With standard dilution at each stage, founders can end up with single-digit ownership

This can kill motivation and create misalignment with investors

The Fundraising Treadmill Problem

One concerning trend I've noticed recently is what I call the "round-skipping syndrome." Too many founders are obsessed with quickly jumping from seed to Series A to Series B without building sustainable businesses.

They treat fundraising as the product, not the actual company. Each round becomes a performance where the startup is positioned as having massive potential, even when the fundamentals don't support it. This creates a house of cards that eventually collapses, usually around Series B or C when growth metrics can't be faked.

When your company becomes a fundraising vehicle rather than a business-building exercise, you're setting yourself up for failure. The best companies raise because they need capital to accelerate already-working models, not to figure out if their idea can work at all.

Exceptions to the Rule

It's worth noting that hard tech businesses like biotech, hardware, deep tech, and climate tech often see higher dilution per round due to:

Longer paths to revenue

Higher capital requirements

Greater technical risk

Specialized investor pools

In these sectors, 25-35% dilution in early rounds isn't unusual, but should come with investor support that matches the capital intensity.

Negotiation Tips From My VC Days

As someone who sat on the other side of the table, here are a few tactics I used to see founders successfully negotiate better terms: P.S. - You can book a call with me here

Create competition - Even the appearance of multiple interested parties improves terms

Stage your raise - Secure a smaller lead with better terms, then fill the round

Know your numbers cold - Uncertainty leads to higher dilution as risk compensation

Set a clear use of funds - Specific milestones tied to capital inspire confidence

Understand the fund economics - A $250M fund needs different ownership than a $25M fund

Final Thoughts

Remember that fundraising is just one aspect of building a successful company. While important, it shouldn't overshadow product development, customer acquisition, and building a sustainable business model.

The best founders I've worked with maintain perspective even during intense fundraising periods, keeping their focus on building something customers love.

Until next week, keep building and negotiating with confidence!

Until next time, signing off

Sayanee Bhowmik

If you like reading My Unicorn Club - The Startup Newsletter - spread the word and share it with someone who might need it :)

This is a very important topic many of the them are not aware. Thanks for putting together all this information.