Metrics to Chase for Different Stages of Funding

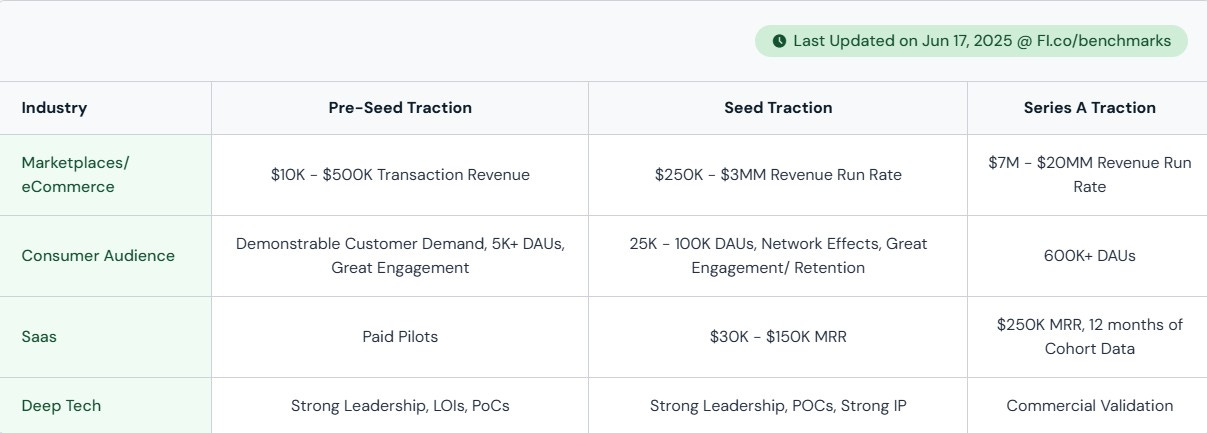

Clear benchmarks by funding stage and industry (as per 2025 data)

Hey founders,

Welcome to another edition of My Unicorn Club - The Startup Newsletter. It's a biweekly FREE newsletter written by those on this side of the table (VCs & Investors) for those on that side (Founders & Startup Enthusiasts)

Yesterday, I ran a quick poll in the Inner Circle group (our space for the most engaged readers in MUC) and noticed a strong interest around one core topic: “Different Metrics for Different Stages of Funding.” So, I reached out to a few subscribers to dive deeper into their questions and pain points—and in today’s edition, I’m addressing exactly that.

If you’ve got specific questions you’d like answered in future editions, just reply to this email. I’ll make sure to include them.

In this edition, I have compiled the most current data on what investors are funding as of mid-2025. Read to know more about the shifts

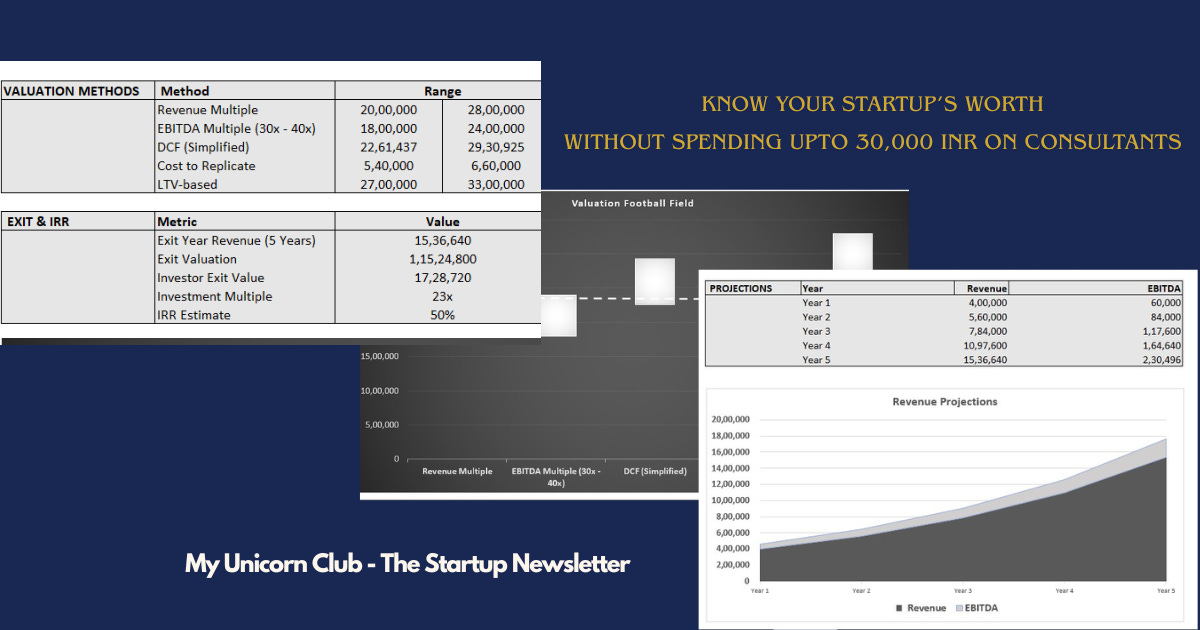

In case you missed it: If you haven’t used the Startup Valuation Calculator yet, this is your chance to grab it at 50% off.

It also models:

Your 5-year revenue and EBITDA projections

Investor IRR, ROI, and exit value

A football field graph that visualizes your valuation range

Use code MUC50 by Thursday, July 10, to get investor-ready in under 10 minutes.

The Numbers Game: Industry-Specific Traction Benchmarks

Let's start with the concrete numbers. I've organized these by industry since comparing a marketplace to a deep tech startup is like comparing apples to rocket ships.

🛒 Marketplaces & eCommerce

Pre-Seed: $10K–$500K in transaction revenue

Seed: $250K–$3MM revenue run rate

Series A: $7MM–$20MM revenue run rate

What's changed here? The Pre-Seed bar has lowered slightly from 2024. Investors are more willing to bet on early marketplace traction, but they're being much pickier about unit economics at Seed stage.

👥 Consumer & Social

Pre-Seed: 5K+ DAUs with strong engagement metrics

Seed: 25K–100K DAUs, clear network effects, solid retention

Series A: 600K+ DAUs

The big shift here is the focus on engagement over growth. I'm seeing investors dig deep into day-7 and day-30 retention rates rather than just looking at download numbers.

💻 SaaS (Software as a Service)

Pre-Seed: Paid pilots (yes, paid!)

Seed: $30K–$150K MRR

Series A: $250K MRR with 12 months of cohort data

This is where things get interesting. The "freemium until Series A" playbook is dead. Investors want to see actual paying customers from day one, even if it's just pilot revenue.

🧠 Deep Tech

Pre-Seed: Strong team, Letters of Intent, solid Proof of Concepts

Seed: Validated PoCs, IP protection, continued team strength

Series A: Commercial validation (actual customers using the tech)

Deep tech remains the most relationship-driven funding category, but even here, investors are pushing for earlier commercial validation.

The Full Funding Picture: What Each Round Looks Like

Beyond just revenue numbers, here's what investors are evaluating at each stage:

🟢 Pre-Seed Stage

Monthly Revenue: $1–$50K

Growth Rate: 0–20% month-over-month

Team Size: 2+ people

Product: MVP with real users

Typical Round: $25K–$2MM

Valuation Range: $1MM–$8MM post-money

Who's Investing: Friends & family, angels, pre-seed funds

The key insight here? Investors care more about customer validation than perfect metrics. They want to see real people using and paying for your product, even if the numbers are small.

🟡 Seed Stage

Monthly Revenue: $50K–$200K

Growth Rate: 15–30% month-over-month

Team Size: 4+ people

Product: Scalable and robust

Typical Round: $2MM–$5MM

Valuation Range: $8MM–$32MM post-money

Who's Investing: Seed VCs, accelerators, strategic angels

This is where product-market fit becomes non-negotiable. Investors want to see that you've moved beyond "people will use it" to "people will pay for it consistently."

🔵 Series A

Monthly Revenue: $200K+

Growth Rate: 25%+ month-over-month

Team Size: 8+ people

Product: Market-ready and commercial

Typical Round: $6MM–$30MM

Valuation Range: $20MM–$50MM post-money

Who's Investing: Growth VCs, corporate VCs, existing investors

Series A is all about expansion. Investors want to see that you've proven the model works and now you're ready to scale it aggressively.

Four Critical Insights for Your Fundraising Strategy

1. MRR is Still King (But Context Matters)

For SaaS startups, that $250K MRR threshold for Series A isn't just a number—it needs to come with 12 months of cohort data. Investors want to see customer behavior patterns, not just growth curves.

Action step: If you're building SaaS, start tracking cohort retention from your first paying customer. Use tools like Mixpanel or Amplitude to build these reports early.

2. DAU Quality Beats Quantity

Consumer startups need to shift focus from user acquisition to user engagement. The apps raising Series A rounds in 2025 have 600K+ DAUs, but more importantly, they have day-30 retention rates above 25%.

Action step: Audit your retention metrics. If day-7 retention is below 40% or day-30 is below 20%, pause growth spending and focus on product improvements.

3. Deep Tech Validation is Getting Earlier

Even in deep tech, where commercial validation traditionally came later, investors are pushing for real customer usage by Series A. This doesn't mean massive revenue, but it does mean someone is using your technology in production.

Action step: If you're building deep tech, start having commercial conversations 6-12 months before you plan to raise Series A. Even pilot programs count as validation.

4. Valuations Are Holding Steady

Despite all the market volatility, valuation ranges have remained surprisingly consistent with 2024 levels. This suggests investors are focusing more on fundamentals than market timing.

Action step: Don't wait for always "better market" to raise. If you hit these benchmarks, there's capital available at fair valuations.

Know how to “Time your Market” here for Fundraising :

The Bottom Line

Raising capital in 2025 isn't about having the perfect pitch deck or the most innovative idea. It's about having measurable traction that proves people want what you're building and will pay for it consistently.

The founders who are successfully raising rounds right now aren't the ones with the flashiest demos—they're the ones with the clearest evidence that their business model works.

Data sourced from FL.co/benchmarks, updated June 17, 2025

Join The Inner Circle to get included in the day-to-day activity behind this newsletter

Quick favor: If this breakdown helped clarify where your startup stands, hit reply and let me know which benchmark surprised you most. I read every response.

Grab the Startup Valuation Calculator now at 50% OFF. Use Code: MUC50

Until next time, keep building!

P.S. Forward this to any founder friends who might be fundraising—they'll appreciate the clarity.

Resources:

Startup Valuation Calculator Use - MUC50 for 50% OFF

Pre-Money ↔ Post-Money Calculator Use - MUC50 for 50% OFF

If you like reading My Unicorn Club - The Startup Newsletter - spread the word and share it with someone who might need it :)