Hey founders,

Welcome to another edition of My Unicorn Club - The Startup Newsletter - It’s a biweekly FREE newsletter written by those on this side of the table (VCs & Investors) for those on that side (Founders & Startup Enthusiasts).

Let’s begin…

As I dive into my third month of full-time startup mentoring after my time in venture capital, I'm continually struck by the knowledge gap between investors and founders. This week, I want to pull back the curtain on a critical but often misunderstood part of the venture ecosystem: the people who fund VCs themselves.

Who Are Venture LPs? The Hidden Force Behind Your Funding

Venture Limited Partners (LPs) are the investors who provide capital to venture capital funds, essentially serving as the financial backbone of the venture ecosystem. These LPs make long-term financial commitments (typically 7-10 years) to venture capital firms, who then deploy this capital across promising startups in exchange for management fees and a percentage of investment returns, creating the financial structure that enables venture capitalists to back early-stage companies while LPs gain exposure to high-growth potential startups without directly managing individual investments.

We often imagine venture capital Limited Partners (LPs) as massive institutions with endless capital—university endowments like Harvard's $50B behemoth or sovereign wealth funds managing trillions. But the reality is far more nuanced and personal than most founders realize.

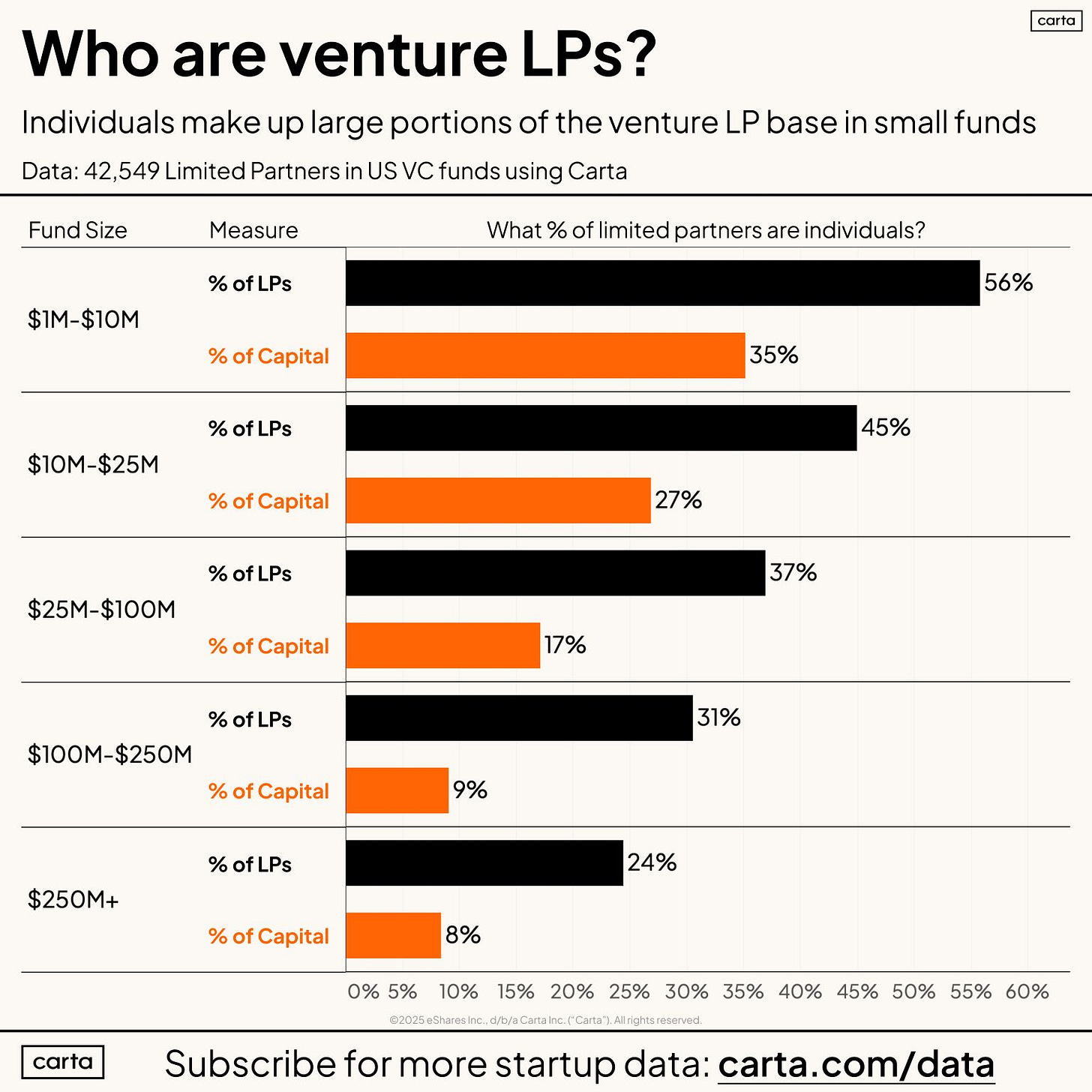

Here's the surprising truth: More than 40% of LPs into VC funds under $100M are individual people, not faceless institutions.

Yes, these individuals are accredited investors with significant net worth, but they're also real humans making active decisions to put their personal capital to work in small startups through emerging fund managers. They're betting on you—often more directly than you might think

The Data Tells an Interesting Story

When we break down the numbers:

Individual LPs represent over 50% of all investors in funds under $10M

They contribute more than 25% of all committed capital to funds under $25M

They provide one-fifth of the total capital flowing into funds under $100M

Even in larger $ 100 M-$250 M funds, individuals still make up approximately one-third of the LP base

The remaining capital predominantly comes from family offices and larger institutions (endowments, pensions, foundations, fund-of-funds, etc.).

Why This Matters For Founders

This LP structure creates several important dynamics that directly impact your fundraising journey:

Shifting Investment Philosophy: VC firms often adjust their investment thesis and approach from fund to fund based on their LP composition and market conditions. When a firm raises a new fund with different LP backers, their strategic priorities may pivot significantly - from deep tech to consumer, from seed to growth, or from patient capital to quicker returns.

This explains why founders sometimes experience confusing investor behavior, where their VC contact seems enthusiastic in one meeting but hesitant in the next. What appears as inconsistency is frequently the result of behind-the-scenes pressure from LPs who are influencing investment committee decisions. When your investor suddenly becomes more demanding about metrics or less willing to participate in follow-on rounds, it's often a reflection of shifting LP expectations rather than a loss of faith in your specific venture, making it crucial for founders to understand the broader LP dynamics affecting their investors' decision-making processes.The Early-Stage Funding Crunch: Individual LPs often can't recycle capital into new funds until they see returns from previous investments. With the recent slowdown in exits, many individual LPs are capital-constrained, directly contributing to the early-stage funding squeeze we're seeing today.

Fund Manager Pressure: Your VC's individual LPs may have shorter time horizons and different return expectations than institutional investors. This can affect how your investors approach follow-on decisions, exit timelines, and risk tolerance.

Relationship Networks: Individual LPs often bring valuable personal networks that can benefit portfolio companies. Smart founders find ways to leverage these connections beyond just the capital.

The "Emerging Manager" Cycle: The ecosystem needs individual LPs to back first-time fund managers, who in turn are often the most willing to back first-time founders. This symbiotic relationship drives innovation at the earliest stages.

The Round-Hopping Trap: A Warning to Founders

One concerning pattern I've noticed in my mentoring work is what I call "round-hopping"—founders who fixate on raising the next round before proving their current business model. They treat fundraising itself as the product, with each new round serving as "validation" rather than focusing on building sustainable businesses.

The hard truth is that investors can see through this. When a founder comes pitching their Series A with minimal progress on the metrics that matter, it signals either:

Poor execution capabilities

A fundamental flaw in the business model

Misaligned priorities around what constitutes success

The startups that gain lasting investor confidence are those showing disciplined progress on core metrics between rounds—customer acquisition costs, retention, unit economics, and product-market fit indicators.

My advice: Focus on building a business that works with the capital you have, not racing to raise more before you've proven your model. The best fundraising strategy is building something that genuinely works.

What I'm Working On For You

I've been listening to your feedback about the challenges first-time founders face in navigating the venture landscape. In response, I'm developing two new resources:

The Dynamic Investor Database - A continuously updated list of active investors categorized by focus area, check size, and investment criteria. Available soon for just ₹99/month. This is specifically designed to help you find the right investors for your specific stage and sector.

Venture Capital 101: A Founder's Guide - A comprehensive crash course on how VC functions, including term sheet negotiations, cap table management, and how to speak the language of investors. This will help first-time founders avoid common pitfalls and negotiate better deals.

Are these resources you'd find valuable? Reply to this email or DM me directly to share your thoughts and register your interest. I'm building these tools based on your needs, so your input is invaluable.

Final Thought

Here's to the individual LPs backing emerging funds, to the emerging managers backing first-time founders, and to all of you building the next generation of transformative companies.

And here's hoping for more exits in 2025 to get that capital flowing again!

Until next time, signing off

Sayanee Bhowmik

If you like reading My Unicorn Club - The Startup Newsletter - spread the word and share it with someone who might need it :)

As a hopeful founder looking for capital, this is really useful- looking forward to the investor database

Hiiii I’m currently a biochem and biotech major and I aspire to be a biotech venture capital analyst. What advice do you got for me in terms of where do I start and where do I set my sights on? 💖✨ thank you for your newsletter 💖✨